Discover If You Qualify

As a leading ERTC company, we fully understand everything needed to

obtain ERTC Advance funding. Your business has to meet specific

qualification requirements. However, there is much more to

interpreting each eligibility criteria than what meets the eye.

Discover If You Qualify

As a leading ERTC company, we fully understand everything needed to

obtain ERTC Advance funding. Your business has to meet specific

qualification requirements. However, there is much more to

interpreting each eligibility criteria than what meets the eye.

Leveraging our expertise and experience dealing with ERTC, our team will work with you to maximize your eligible claim. To be eligible for the 2020 and 2021 ERTC, a business or tax-exempt entity can stake its claim if:

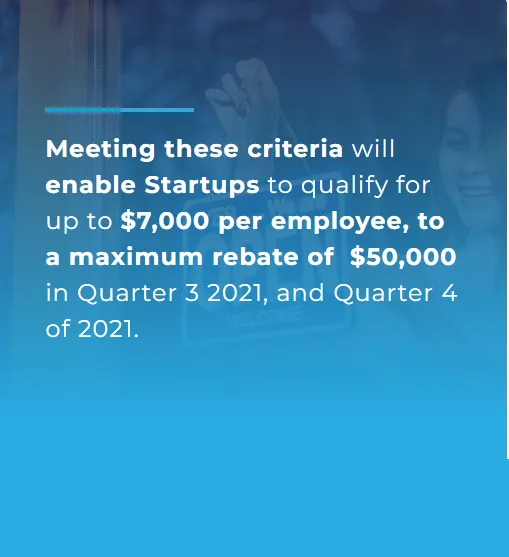

STARTUPS are not left behind

As a measure to make the ERTC more inclusive, the ERTC program eligibility criteria were expanded to accommodate Startups:

Startups established after February 15th, 2020

Gross yearly revenue cannot exceed $1 million

Don’t Let Misconceptions Hold You Back From Claiming Your ERTC Credit.

The ERTC tax incentive is heavily underutilized due to misconceptions surrounding eligibility. Take a look at some of the most common ERTC misconceptions.

We had no revenue decline

Revenue is one of many factors that determine whether you qualify for ERTC. In fact, companies without a considerable revenue decline can still qualify for the employee retention tax credit.

We never shut down our business

The ERTC tax incentive has several provisions that make it possible for employers who were not forced to completely shut down their business to qualify for the ERTC. Businesses that were forced to partially shut down their business can make a claim. Additionally, those businesses without a government mandate to shut down or partially shut down their business can still qualify through revenue decline.

Our business is not essential

Our business is not essential

Your business does not have to be deemed essential to qualify for employee retention tax credit.

Our revenue went up after a shift in the market

The ERTC tax incentive has several provisions that make it possible for employers who were not forced to completely shut down their business to qualify for the ERTC. Businesses that were forced to partially shut down their business can make a claim. Additionally, those businesses without a government mandate to shut down or partially shut down their business can still qualify through revenue decline.

We have received a Paycheck Protection Program loan before

Companies that have received one or both PPP fundings are eligible for the employee retention tax credit.

It’s too late to apply for the ERTC

If eligible, employers can claim the ERTC for qualified wages paid in 2020, as well as Q1, Q2, and Q3 of 2021.

We had no revenue decline

Revenue is one of many factors that determine whether you qualify for ERTC. In fact, companies without a considerable revenue decline can still qualify for the employee retention tax credit.

We never shut down our business

The ERTC tax incentive has several provisions that make it possible for employers who were not forced to completely shut down their business to qualify for the ERTC. Businesses that were forced to partially shut down their business can make a claim. Additionally, those businesses without a government mandate to shut down or partially shut down their business can still qualify through revenue decline.

Our business is not essential

Our business is not essential

Your business does not have to be deemed essential to qualify for employee retention tax credit.

Our revenue went up after a shift in the market

The ERTC tax incentive has several provisions that make it possible for employers who were not forced to completely shut down their business to qualify for the ERTC. Businesses that were forced to partially shut down their business can make a claim. Additionally, those businesses without a government mandate to shut down or partially shut down their business can still qualify through revenue decline.

We have received a Paycheck Protection Program loan before

Companies that have received one or both PPP fundings are eligible for the employee retention tax credit.

It’s too late to apply for the ERTC

If eligible, employers can claim the ERTC for qualified wages paid in 2020, as well as Q1, Q2, and Q3 of 2021.

Begin Your Claim - Answer

10 Questions

Your time investment will be under 15 minutes – guaranteed.

And could be worth tens of thousands in free money.

Phone Number: (360) 317-2108

Address: 3571 Far West Blvd

Austin, TX 78731

© 2022 ERTC Fast Program™. All Rights Reserved

The information contained herein is the property of ERTC Fast Program ™, which reserves all rights thereto. Redistribution of any part of this information is prohibited without the express written consent of ERTC Fast Program ™. ERTC Fast Program ™ is not responsible for any errors in or omissions to this information, or for any consequences that may result from the use of this information.